WORX

Payroll

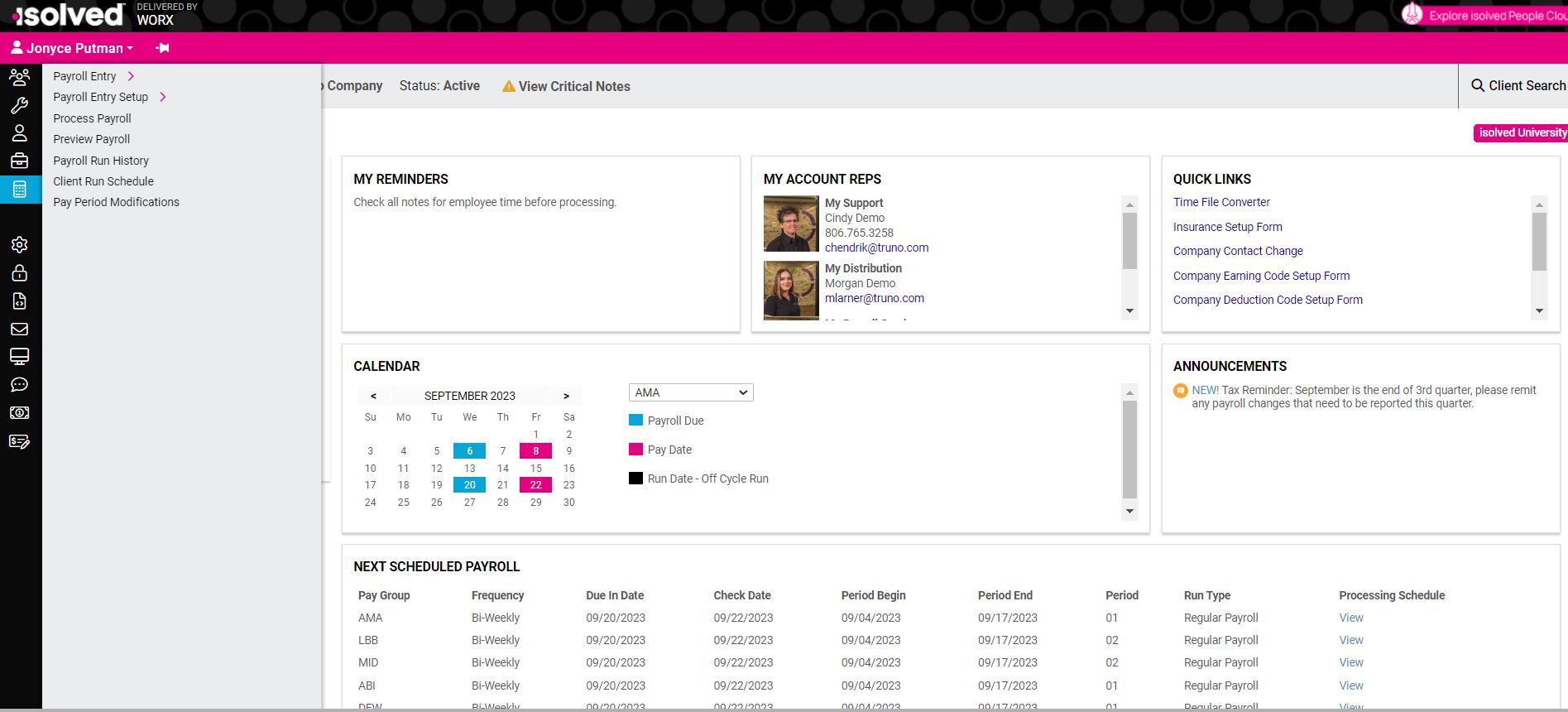

In today’s ever-changing workforce, employees need easy self-service options for handling their compensation and promptly accessing their pay. WORX simplifies payroll processing with just a few clicks, relieving you from the complexities of tracking employment tax rates, computing liabilities, generating reports, and handling payments. It offers a personalized employee experience and allows for self-service onboarding, updates to direct deposit and personal info, tax filing, and much more.

Evolve WIth Your Worforce

Streamline the handling of direct deposits, pay cards, and immediate access to earned wages for employees with diverse job classifications, locations, and lifestyle preferences through automation.

Tax Filing & Compliance Automation

Reduce your administrative workload with WORX, which automates tax calculations, filing, and payments to government agencies. This not only helps you secure eligible tax credits but also minimizes the risk of penalties due to payment inaccuracies.

Gain Valuable Operational Insights

Harness the power of integrated reports that provide insights into cash needs, past payroll information, W-2 notifications, and tax deposit notifications. This will help you streamline operations and save on costs.

Payroll

With WORX, you gain more control over your payroll processes via a secure, modern, and connected platform. Process payroll in just a few clicks and let WORX handle the rest! WORX pays employees, calculates liabilities, creates reports and makes payments.

Features:

Payroll, Taxes, Garnishments, Compliance, Year-End Preparation, Custom Reporting

Designed for:

Small businesses looking to make payroll more efficient and accurate.

Payroll & Complete Human Capital Management

WORX is a cutting-edge Human Capital Management (HCM) platform designed to enhance the overall employee journey. This platform seamlessly handles all aspects of HR and employee management and is designed to easily adapt to the evolving needs of forward-thinking organizations.

Designed for:

Medium to large-sized businesses, or small businesses with expansion plans, needing consistent and easy to access hiring, onboarding, performance, and training platforms.

Features:

Human Resource Management, Time & Attendance, Hiring, Onboarding, Applicant Tracking, Staff Learning & Development

Features & Benefits

Payroll

Get a full payroll preview that provides alerts of potential errors before you process.

Lets you tailor tasks to your payroll cycle

Automates tasks, such as cutting checks or sending direct deposits, ensuring timely payments

Allows you to track and process Federal and State taxes for seamless compliance

Provides comprehensive reports to simplify regulatory filings, audit preparation, and more

Integrates with employee data from WORX Attendance or POS programs to streamline processes

Simplifies ACA compliance with up-to-date definitions and standards for peace of mind

Employees are your most valuable asset. Having the right tools helps you take care of your employees and keep your business running. By consolidating these tools into a single portal, you can streamline processes and create efficiencies that save you time and money.

With the WORX Payroll suite of tools, you can manage employee payroll, time & attendance, onboarding, and more from a single portal that provides a comprehensive solution. These solutions are backed by experience and expertise, so you can feel confident that WORX Payroll will guide you and your team on the road to success.

About WORX

Solutions

Contact Us

Tel: 806.765.3258

Toll-Free: 800.657.7108

Fax: 806.765.3102

Office

6203 98th Street

Lubbock, Texas 79424